This entry is an activity for Teach-Now while working towards a teaching certificate. Specific goals and requirements had to be met by this entry and is by no means designed to be an independent feature.

The Huffington Post posted an article October 14, 2014 titled Poverty The Strongest Factor in Whether High School Graduates Go To College. The article summarized a report from National Student Clearinghouse regarding the factors and statistics of high school students with the hopes of attending college. Unfortunately, hope only seemed to glimmer the brightest on those with the most. The organization identified low-income students and then evaluated this group based on past records of other low-income enrollment rates. They found that schools with low-income students “had 47% to 58% college enrollment rates” compared to the 61 – 70% for high-income schools. Beyond the challenge some students face of the every-day education career, they are also burdened with the future hardship that is required of them if they expect to succeed in this highly competitive industrial global economy.

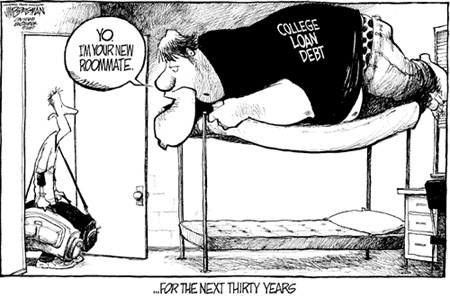

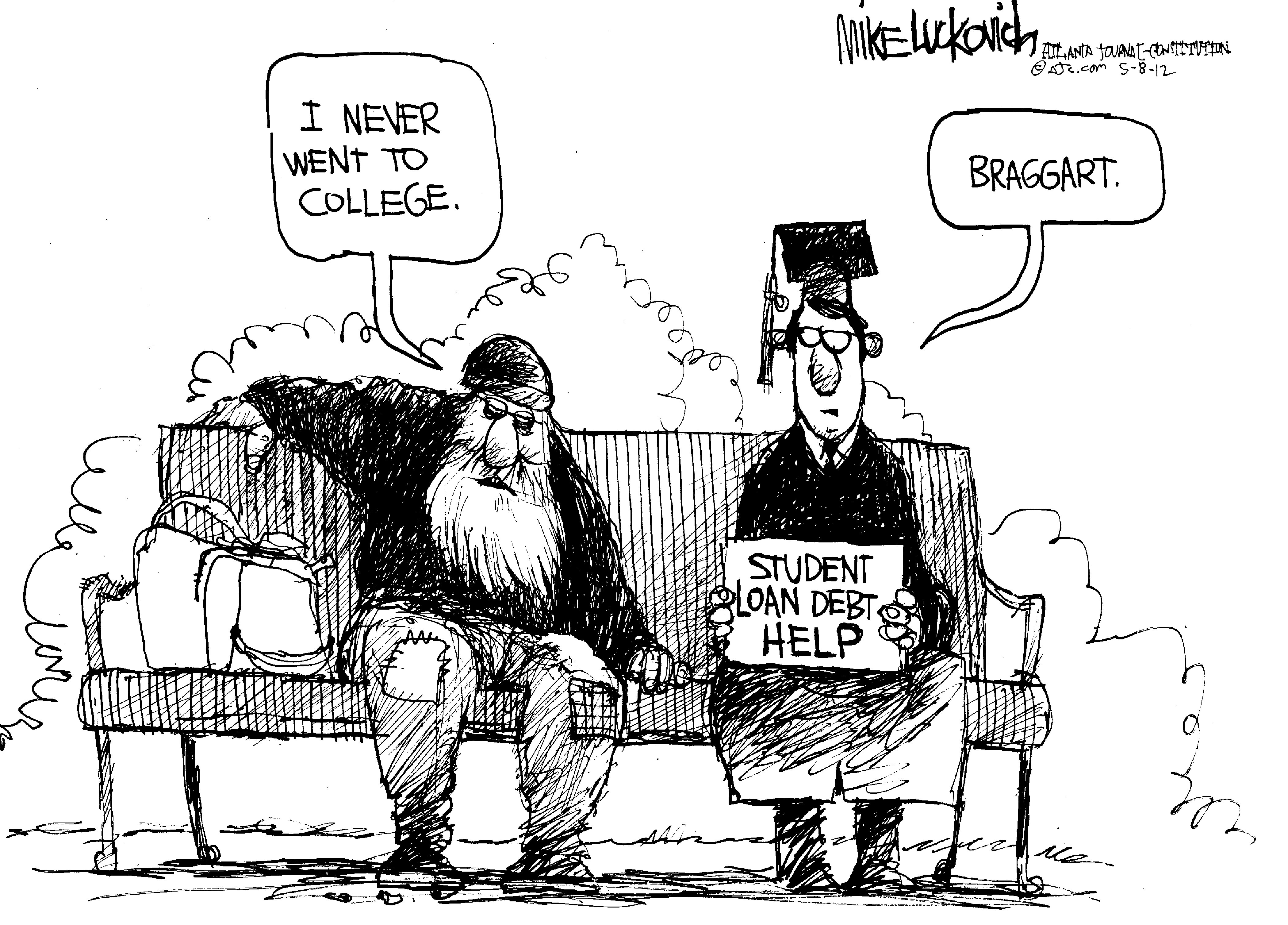

Young students are already burdened with the necessity of going to college — compound that with the cost of secondary education and wonder why there is discouragement.

College Is Getting Expensive

Beyond the concern that colleges and universities may be an institution of the past (Sweet, 2015), the price of acquiring a degree is very expensive. According to CollegeBoard.org, the average cost for a 4-year out-of-state public school is $32,762 for the year 2014-15 (CollegeBoard.org, n.d.). The United States Department of Education provides a tool called the College Affordability and Transparency Center. This tool is somewhat of an evaluation calculator that refines data based on your criteria for school attendance. For instance, a person can choose to attend a “Private for-profit, 4-year or above” sector (sounds expensive already) that has the lowest tuition. For illustration lets try a 4-Year Public school Net Price and find the results of that — net price is essential the average cost to attend 1 year of school after any financial aid (DEP, n.d.).

The Results

The highest school was Miami University-Oxford of Ohio $24,674 (CollegeBoard.org, n.d.). Visiting the school website— Miami U of Oxford, Ohio— for their tuition and costs information. You will discover that for this coming year, out-of-state total cost is $41,449 (Miami University-Oxford, 2015). The total cost is what most people forget to consider — the expenses for living, eating, books, supplies, classroom fees, and random other fees of services you may not even use such as the Transit fee or even the General Fee which partly supports the Goggin Ice Arena (you better go get your skates!).

The next highest according to CollegeBoard.org was Penn State, Pennsylvania at $22,560 (CollegeBoard.org, n.d.). As for Penn State, they too provide a calculator to find your estimated investment in their facility. For the experiment, we will attend Penn State at University Park, “The largest Penn State campus offers academics, activities, and recreation in the classic college town of State College (Penn State, 2015).” They estimated a price per year of $43,200. One fee with an alarming cost is the $504 Computer fee which gives you an email account and access to the world wide web. What is the difference in service of Penn State internet service provider compared to that of say Comcast or Optimum? Rhetorical question for its seems that may be inflated unless every kids also receives a dedicate wi-fi, unlimited data, no restrictions, etc… but this is not the point. Within CollegeBoard.org’s results, Penn State interestingly held 7 of the top 33 expensive net cost schools.

The next highest according to CollegeBoard.org was Penn State, Pennsylvania at $22,560 (CollegeBoard.org, n.d.). As for Penn State, they too provide a calculator to find your estimated investment in their facility. For the experiment, we will attend Penn State at University Park, “The largest Penn State campus offers academics, activities, and recreation in the classic college town of State College (Penn State, 2015).” They estimated a price per year of $43,200. One fee with an alarming cost is the $504 Computer fee which gives you an email account and access to the world wide web. What is the difference in service of Penn State internet service provider compared to that of say Comcast or Optimum? Rhetorical question for its seems that may be inflated unless every kids also receives a dedicate wi-fi, unlimited data, no restrictions, etc… but this is not the point. Within CollegeBoard.org’s results, Penn State interestingly held 7 of the top 33 expensive net cost schools.

The Challenge

The American Federation of Teachers said it right regarding the massive education debt – (American Federation of Teachers, 2012) “Today, many students face a stark choice: go to college and acquire a mountain of debt that will come due right after graduation, or forgo college altogether.” The cost of education is not so much just the financial burden after graduation, the cost affects the decision of going to college. Here is the conundrum: go to college and cannot afford to pay a home or provide for a family; or do not go to college and not have access to the advanced job field of higher wages that require a degree?

One of the biggest swings to the cost increase is simply disinterest. AFT continues in the same report that federal and state commitments and investment have waned “only 10 percent or less of many public universities’ budgets” which causes the schools to increase their costs. This increase not only potentially discourages able students to attend schools, but also decreases the chance for the low-income students to acquire enough financial aid before applying for loans. As a result, the following generations will be lacking in what society calls the necessary education for the new work force. This lack of workforce will mean a lack of income which will mean a lack of investments such as houses or simply inputting into the industrial economy. Looks like a sign of no-growth.

The social and civic benefits of a college education are also well-documented. College graduates tend to be healthier and put fewer demands on social service and safety net programs. They also have higher rates of volunteerism and civic participation. It is clear that college not only provides knowledge and skills that are important economically for both individuals and their communities, but it also plays a foundational role in developing the educated and engaged citizenry that is essential in a healthy democratic society. (AFT, 2012)

The Contenders and Actions to Battle the Cost

So you have attended college, and now wonder how to pay off those loans. One could rely on this person’s advice which may or may not be helpful, or simply find security with other authorities.

The National Education Association

This collection of education professionals’ interests are protecting the rights of students and providing accessibility for education. In a nutshell, they support students and their success. Based on NEA’s (NEA, 2014) assessment of $1.2 trillion in education loans and that 5 million borrowers have fallen behind on their payments, one of their concerns is college affordability. Their Degrees Not Debt campaign raises awareness of this issue as well as ways to make college education more affordable. One message is a great video story chalked out explaining hope for those experiencing this dread. The video explains of two ways to reduce a student loan: one is the Income Driven Repayment; the other is the Public Service Loan Forgiveness.

The Income Drive Repayment has a few payment programs designed to reduce the payment based on factors such as income, family size, home/living costs. The applicant must show financial hardship partially due to their loan payments. The other program is Public Service Loan Forgiveness that essentially allows a person who works within the public service arena such as a fire fighter, law enforcement, or education to earn a reprieve after 10 years of flawless payments. But these two programs only help those who have loans and are aware that this assistance exists.

Through their campaign, NEA proposes solutions that Congress should consider and act upon to fix this crisis of the ever-increasing education cost (NEA, 2014):

- Congress could increase grant aid to decrease the loan supplement;

- decrease the cost of loans by easy refinance options during lower interest rates;

- enhance the public service loan forgiveness with a broader and more forgiving stroke;

- support increasing federal and state aid through incentives.

Maybe the government is listening.

President Obama and his administration’s efforts are aiming to “[help] middle class families afford college (The White House, 2015, Higher Education).” They have estimated that the 2010 graduates have an average of $26,000 plus in college loans. The daunting weight of this responsibility makes getting a necessary degree seem even less likable to do. Education is a must to create the leverage for a skilled work force. But with the goal to create an advanced or at least competitive industrial and innovative American market, Obama worked to increase federal support for education. Amazingly, his efforts seem almost parallel in answering what NEA suggested:

- “The President has raised the maximum Pell Grant award to $5,730 for the 2014-15 award year” by doubling the Government’s investment in Pell Grants — this action was a result of the Health Care and Education Reconciliation Act of 2010 (The White House, 2015, Making College Affordable);

- Stafford loan rates remained at 3.4% rate saving a graduate roughly $1,000 (The White House, 2015, Keeping…);

- the Obama Administration broaden the eligibility for IBR or Income-Based Repayment which allows more people the chance to lower their monthly education loan payments (The White House Blog, 2015);

- and, not on a point as suggested, established the American Opportunity Tax Credit based on community service (Wikipedia.org, 2015) but the IRS states it is simply a credit based on college expenses considering income (IRS, 2014).

Forgiveness

As mentioned before, forgiving a loan is based on the type of job and the maintenance of that loan before the forgiveness request. Another program is the Teacher Loan Forgiveness created by the Higher Education Amendments of 1998 to the Higher Education Act of 1965 (Ed Financial Services, n.d.). The program promises a haven but there are strict eligibility requirements; one requirement is the location of teaching. The teacher must have been teaching for at least 5 consecutive years at a low-income school (Federal Student Aid, n.d.). But you cannot be just any teacher, you have to be a “highly qualified teacher.” The Federal Student Aid defines that as being certified, having at least a B.A. degree, and successfully passing rigorous state examination regarding your subject.

But here is a better perk of being a teacher and you have a Federal Perkins Loan. This cancellation is less stringent on the number of years teaching, but still requires that the school be identified as a low-income school.

The Future

So, in the dark tunnel of college costs, there may be a faint glow at the end — how strong of a glow (or flicker) depends on the durability and constant of Congress. A beauty of this country’s government structure is that our representatives’ have term limits. No matter who they are—the local mayor to the President of the United States— if they have not matched our expectations, we can vote them out at the end of their term and hope for better change. This beauty is also a downside. Each new office can change the previous terms’ policies and development. Obama has created some policies to alleviate or assist the recovery of education loans, but how respected are these policies, how long will they last? Only time will tell.

Something Else to Consider

The Strength for Strong Teachers

The Council of Chief State School Officers (CCSSO, 2012) comprises of public officials of state education departments. This nationwide organization of members representing all districts and territories of the United States work by a member consensus for educational issues organized into a cohesive expression of their viewpoint to the appropriate parties that can facilitate change. In simply terms, the voice the needs of education to those that can make change; because these members are involved in education, they are the authoritative voices to influence that change. Their focus is simply to ensure better students and that is by having better teachers and educational leaders. One case to encourage this quality level is their esteemed recognition program — the National Teacher of the Year Program. This program began in 1952 “and continues as the oldest, most prestigious national honors program that focuses public attention on excellence in teaching.”

It is a Global Economy, So Support Global Education

We are so focused on domestic education to support a global economy that we forget the education need and efforts elsewhere in the world. Luckily Global Partnership for Education (GPE, 2015) has the consideration for the other 58 million plus more children who probably have not seen a classroom or have known a teacher. The biggest effort would not simply be educational equity, but equal opportunity for girls. Far many more cultures still exist with gender inequality. Breaking those barriers will require effort to change cultures. This effort can only happen with the support of the 60 countries participating in the growth of education. GPE’s focus on girls follows a belief that “An educated female population increases a country’s productivity and fuels economic growth (GPE, 2015).”

Unfortunately, the ideal of equal education is equated to billions of dollars lost. But I feel that the effort should be based on the benefits of self-confidence, humanity, and health:

More educated women tend to be healthier, work and earn more income, have fewer children, and provide better health care and education to their children. Girls’ education literally saves millions of lives… (GPE, 2015).

At least the tide is turning: http://www.globalpartnership.org/blog/counting-girls

Resources

American Federation of Teachers. (2012). On the Backs of Students and Families: Disinvestment in Higher Education and the Student Loan Debt Crisis. Referenced from http://www.aft.org/highered/resources

CCSSO, Council of Chief State School Officers. (2012). Referenced from http://www.ccsso.org/

CollegeBoard.org. (n.d.). Retrieved from http://trends.collegeboard.org/college-pricing/figures-tables/average-published-undergraduate-charges-sector-2014-15#Key%20Points

DEP, U.S. Department of Education. (n.d.) .College Affordability and Transparency Center. Referenced from http://collegecost.ed.gov/catc/

Ed Financial Services. (n.d.). Teacher Loan Forgiveness. Referenced from http://www.edfinancial.com/helpcenter/forgiveness/TLF

Federal Student Aid, An Office of the U.S. Department of Education. (n.d.). Retrieved from https://studentaid.ed.gov/sa/repay-loans/forgiveness-cancellation/teacher

GPE, Global Partnership for Education. (2015). http://www.globalpartnership.org/

IRS. (2014). Referenced from http://www.irs.gov/uac/American-Opportunity-Tax-Credit

Miami University-Oxford, Ohio. (2015). Referenced from http://miamioh.edu/onestop/your-money/tuition-fees/oxford-undergraduate-fall-spring-tuition-fees/index.html

NEA, National Education Association. (2014). Future educator Brianna Bolton on #DegreesNotDebt. Referenced from https://www.youtube.com/watch?v=4SgOS95nlEc

Penn State, Pennsylvania State University. (2015). Referenced from http://www.psu.edu/academics/campuses

Sweet, Michael Ernest. (May 31, 2015). Will The University Become Extinct? Retrieved from medium.com – https://medium.com/synapse/will-the-university-become-extinct-e8d88f525b51

The White House, President Barack Obama. (2015). Higher Education. Referenced from https://www.whitehouse.gov/issues/education/higher-education

The White House, President Barack Obama. (2015). Keeping Student Interest Rates Low. Referenced from https://www.whitehouse.gov/dont-double-my-rates

The White House, President Barack Obama. (2015). Making College Affordable. Referenced from https://www.whitehouse.gov/issues/education/higher-education/making-college-affordable

The White House Blog, President Barack Obama. (2015). Referenced from https://www.whitehouse.gov/blog/2012/06/07/income-based-repayment-everything-you-need-know

Wikipedia.org. (18 January 2015). Referenced from https://en.wikipedia.org/wiki/American_Opportunity_Tax_Credit

IMAGE CREDITS in order they appear

Title image – http://www.columbian.com/news/2012/may/09/editorial-cartoon-price-education/

Congrats – http://www.usnews.com/dims4/USNEWS/41d2963/2147483647

Miami University-Oxford, Ohio Logo – http://miamioh.edu/ucm/resources/logo/

Pennsylvania State University Logo – http://www.clubs.psu.edu/hn/sga/images/Seal.jpg

Roommate – https://gendebtcartooncomm.wordpress.com/2012/04/29/a-weight-on-your-shoulders/

Other points to consider regarding the affordability of college education:

- The story of affordability is still one of the rich versus the poor and what resources there are that can provide.

- Beyond the monetary costs, education has been a point of accessibility simply those who have had the academia to encourage the next step.

More opinions on the cost of education…

- https://gendebtcartooncomm.wordpress.com/2012/04/29/a-weight-on-your-shoulders/

- The ever increasing cost for education materials such as textbooks.